No value, no revenue

How to target partners that drive exponential growth

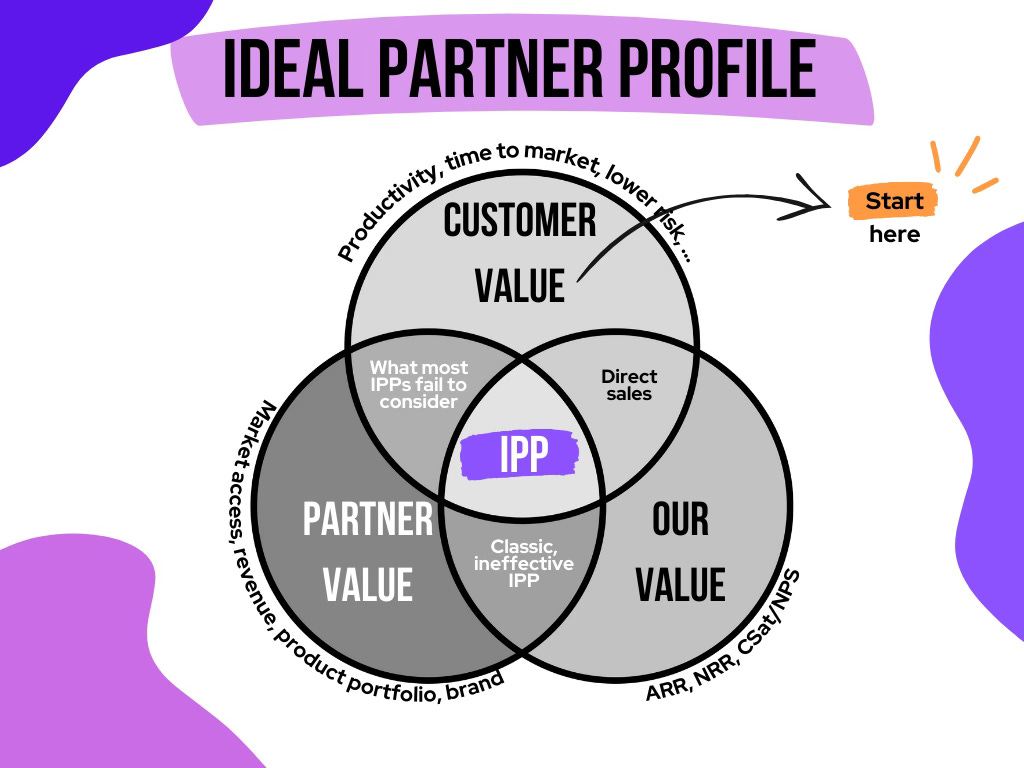

Let’s get the obvious out of the way first: defining and tailoring an Ideal Partner Profile is crucial. Everyone does it. However, over the years, I’ve seen countless IPPs which were too high level, focused on the wrong questions, and were not measurable.

IPP ≠ ICP: We’re selling a business, not a product

Most partner leaders approach an IPP similarly to an Ideal Customer Profile, where they look at partner capacity, pain points, etc. No, it’s not the same. We need to be clear: what are we selling to a partner? Revenue, plain and simple. Who pays? The customer. The challenge in creating an IPP is to not only consider the partner. The stars must align: the customer, the partner, and our business. What unifies the three? Value.

From a partner’s perspective, we’re selling them a business that encompasses not just the product but a lot more.

1. Start with value

Customer value

The most essential factor in selecting partners is their impact on the customer. A typical way to gauge whether a partner can deliver is to determine whether they already serve your ideal customer or even have some customer overlap. In addition, your partners should have the same buyer. Do they have excellent customer reviews? These are the typical table stakes questions.

A question that comes up a lot less is:

Will this partner improve our customer impact by 10x?

Customer impact could include, for example, product adoption, increased cost efficiencies, and faster time to market. By the way, I’ve seen fewer escalations with partners who are primarily customer value-focused. There is something magical about working with partners who want to get things done for the customer.

What’s in it for the partner?

A typical partner fear is keen partner managers chasing them for leads but not articulating what’s actually in it for the partner. Most partners don’t care as much about you; they care about what you can do for their business. (It’s obvious, but it gets lost easily in discussion.)

What’s in it for the partner? Is their business model primarily sales-focused, or does it focus on service revenue? It’s nearly impossible to incentivise a global consulting practice with merely a referral share.

What’s in it for us?

What value will the partner provide? It’s crucial to get a sense of the partner’s customer portfolio. Some large partner empires are harvesting an installed base with mostly existing customers who already have a solution. Such a partner might look good on paper but will do little to help build market presence. Ideal partners are hunters and industry shapers eager to grow with you and provide outstanding customer outcomes.

2. Readiness to execute

If you do the above correctly, you’ve done 90% of the work. The second section concerns feasibility and the partner's ability to deliver. If your IPP starts here, and many do, you’re wagging a dog by its tail.

Partner market presence

Capacity is an important factor, but it sometimes gets too much attention. I’ve seen one-person partners outperform organisations of 1,000+ people. Why? Depending on the product, your business might be playing in a niche that matters more to the one-person partner with extensive industry knowledge, board-level contacts, and a drive to sell that would put your best AEs to shame. Ways to gauge capacity should include revenue, the number of active partner-selling employees, the number of consulting employees, digital presence, and online traffic.

Partner know-how and experience

Partners should have the expertise and the ability to execute to provide value. This includes not only technical knowledge but also the ability to sell if your programme is geared towards revenue growth. Do they already have first knowledge of our product? This can be tested by reviewing customer cases and getting references from other partners or customers in our network.

Reliability and commitment

It’s challenging to gauge partner reliability upfront, and commitment can be difficult to sense. However, this is usually established as a partner relationship progresses. In addition, the best partners can sometimes work 90% with your competitor. Partner leaders watch very closely and look for signals of commitment. These can include, e.g., taking time out for in-person enablement, assigning a dedicated relationship manager, proactive drafting of a joint value proposition or business case, and willingness to invest in co-marketing.

3. How to refine an IPP

Your IPP is never complete; it will constantly evolve as your business grows. Your company might introduce new products or shift its strategy, ultimately impacting your IPP. Moreover, defining an IPP requires tailoring and a deep understanding of your partner portfolio. Developing those insights can take time.

Build a partner leaderboard that measures commercial (e.g., ARR, ARR growth, pipeline, win rates, sales cycle duration) and success metrics (e.g., CSat/NPS, NRR) for each of your partners. Segment partners by IPP vs. non-IPP, size, vertical, region, buyer persona, and more. This will allow you to diagnose who the best-performing partners are. Do not leave it to metrics alone; talk to the best-performing partners and their customers and gain a deep understanding of what makes them successful.

4. Scaling your IPP

Once you clearly understand your IPP, you can boost your program by focusing recruitment on these types of partners. Look for the kind of partners that are in your top 2%. Don’t be too rigid, and leave the door open for inbounds. Your IPP may not have accounted for new types of partners that may be viable, exponential growth avenues.

Why this works

We started developing our IPP with value first. This customer-first, data-driven approach ensures that every partner you work with can be successful from the get-go. Focusing on value before volume will turn your partnerships into sustainable revenue engines—not just vanity alliances.